FPPS vs PPS: Which Payout Model Maximizes Your SHA256 ASIC Mining Profits?

Mining with SHA256 ASICs today is as much about mastering payout models as hashing power. At Headframe, we often hear from new and veteran miners alike: Will FPPS or PPS maximize my real Bitcoin earnings? The answer isn’t just technical—it’s about understanding how each model reflects your mining risk, daily cashflow, and profit maximizing strategy in the volatile world of BTC block rewards and transaction fees. In this guide, we’ll break down the differences, share insights from running a large mining pool, and help you confidently choose the best fit for your operation.

Зарабатывайте больше с Headframe

Присоединяйтесь к майнинг- пулу и получите лучшую доходность в майнинге. Уже более 10,000 майнеров доверяют Headframe

Understanding FPPS and PPS: The Basics

Both payout models aim to solve the same core problem: turning your ASIC’s proof-of-work into predictable Bitcoin payouts, shielded from the highs and lows of solo mining luck. But the details make all the difference—especially after the recent BTC halving, which has made transaction fees a much larger slice of miner income.

PPS (Pay Per Share): Pure Predictability, Pure Simplicity

- Every valid share your ASIC submits earns a fixed BTC payout—no surprises, no variance.

- This payout is purely calculated on the block subsidy (the fixed BTC reward per block), entirely ignoring the transaction fees in the block.

- Perfect for those who value daily income consistency and want to avoid swings—common for smaller operations or cash flow-dependent sponsors.

FPPS (Full Pay Per Share): Capturing Every Satoshi

- Like PPS, you earn a fixed payout per share. But here, you also claim a portion of the transaction fees in each block your pool solves, proportional to your hashrate.

- Headframe’s FPPS model dynamically calculates the average transaction fee revenue (using a rolling-window method), ensuring your earnings reflect real market conditions through the day.

- This can boost your income by 15–40% compared to standard PPS, especially in times of high on-chain activity (think bull markets, heavy mempool congestion, NFT hype etc.).

Profit Comparison: How Much More Can FPPS Earn You?

Let’s get specific. Miners using modern, high-efficiency SHA256 ASICs have seen that after each halving, transaction fees spike—and sometimes they exceed 30% of total block reward. In this new reality:

- PPS ignores these fees. You only get your share of the fixed block reward.

- FPPS gives you BOTH block reward and your proportional share of transaction fees. No more leaving money on the table when fees skyrocket!

| Factor | PPS | FPPS |

|---|---|---|

| Block Reward | ✅ Included | ✅ Included |

| Transaction Fees | ❌ Ignored | ✅ Included |

| Variance | Zero | Zero (fixed payout per share) |

| Potential Earnings (during high fee periods) | Baseline | 15-40% higher |

| Pool Fee (Headframe) | 0.9% | 0.9% |

What About Pool Fees?

Traditionally, many pools charged slightly more for FPPS, citing risk and reserve requirements. At Headframe, we’ve eliminated this tradeoff — our market-leading 0.9% fee applies to both PPS and FPPS models, with zero hidden commissions or withdrawal charges. This means every extra satoshi from transaction fees on FPPS goes into your pocket, not ours.

The Miner’s Dilemma: When Is PPS the Better Fit?

There are scenarios where PPS might be your preferred tool. Based on what we’ve seen from users mining on Headframe:

- Ultra-small ops (1-2 ASICs) where daily predictability trumps maximizing long-term returns (e.g., hobby mining or operational cost payouts in tight cycles).

- Flat network conditions where BTC transaction fees are consistently low, and the potential upside for fee inclusion is minimal.

- Situations with strict accounting requirements where every day must close with a fixed, predictable payout (common with third-party hosting agreements).

Real-World Example: How Much Can FPPS Grow Your Yields?

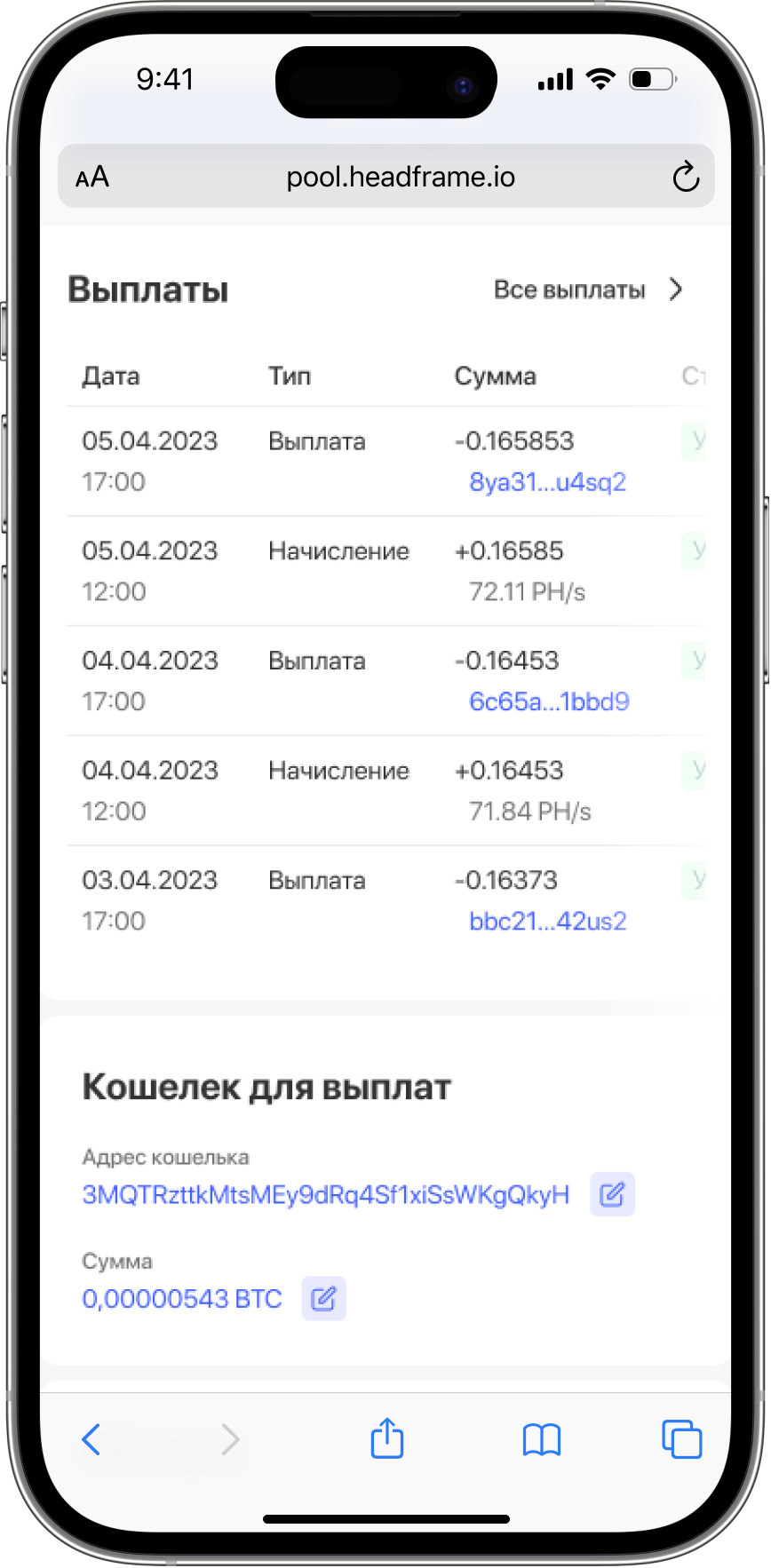

On Headframe, our data for mid-2024 shows that during times of high blockchain activity, FPPS regularly added 18–27% to daily mining earnings compared to PPS. Even in quieter weeks, the average boost stays above 15%. Over a year, this can mean:

- Thousands of extra USD per modern ASIC miner at today’s BTC rates

- Improved ROI, shorter hardware payback horizon, and higher competitiveness—especially critical post-halving as margins tighten

What Risk Does FPPS Add?

This is a common concern for seasoned miners: does giving me a share of all transaction fees mean less pool security? At Headframe, our robust security architecture ensures that all FPPS payouts are always fully reserved and auditable. We practice industry best standards including:

- Daily public payout proofs

- User funds kept segregated from operational balances

- Consistent, compliant KYC and advanced security practices (Zero Trust architecture, 2FA, SOC-compliant data centers)

You can read more about our approach on our website.

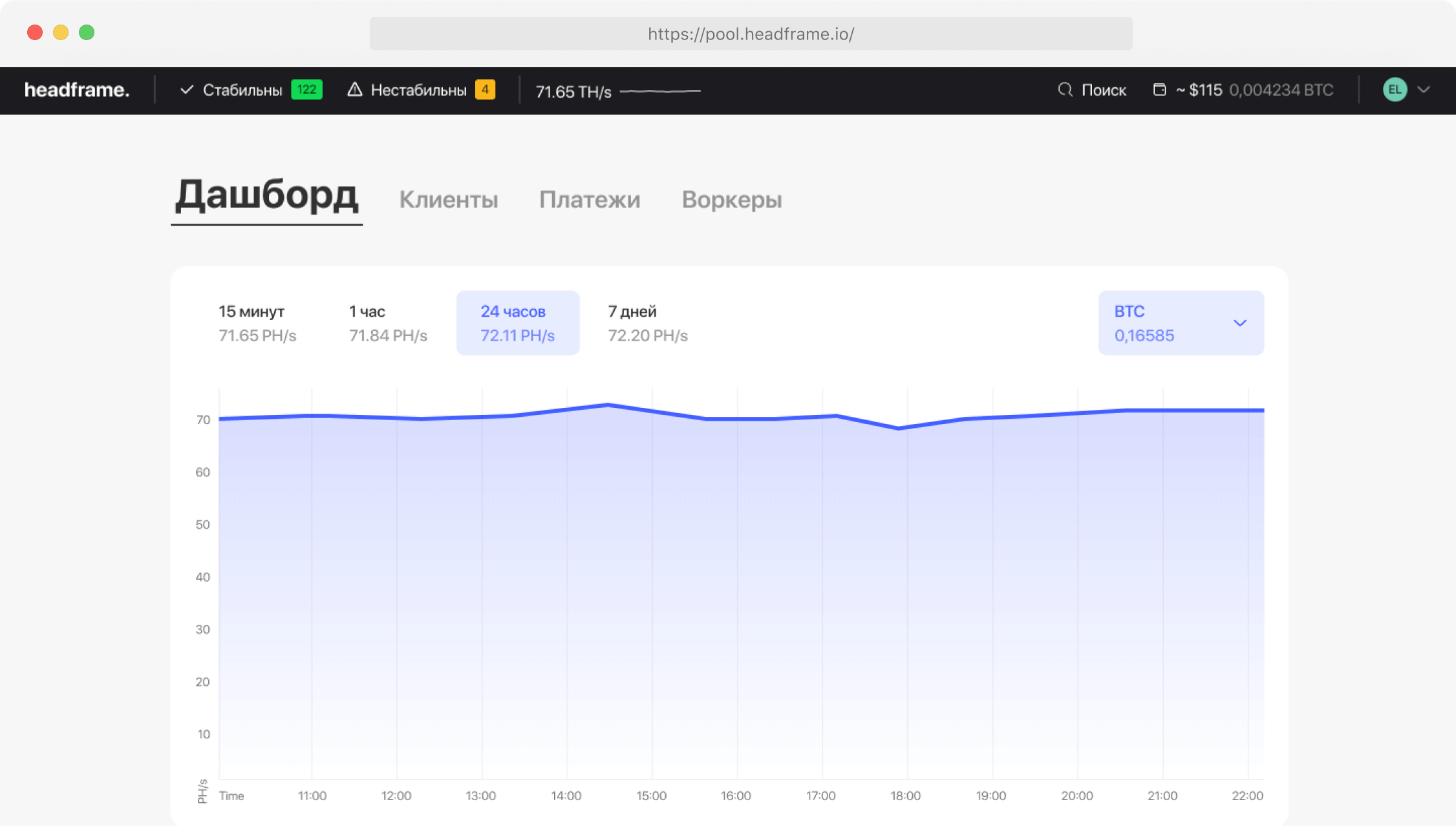

Practical Steps: Switching Between PPS and FPPS on Headframe

We make it simple for every miner to tailor payout models to their strategies:

- Create your secure Headframe account with a unique password and set up 2FA.

- Link your wallet address where you wish to receive BTC payouts.

- Choose your preferred payout model (PPS or FPPS) directly in your dashboard. You can switch at any time—no paperwork or hidden lockups.

- Connect your ASICs using our dashboards for convenient worker/ASIC management and profit tracking.

- Enjoy daily, automated payouts (9 AM calculation, 1 PM funds sent) for relentless cash flow, regardless of model.

Unique Benefits at Headframe (Why Miners Choose Us)

- Ultra-low 0.9% fee—among the very lowest globally, with no upsell or limits on switching between payout methods.

- Stable, fast payouts and 99.5% uptime backed by Kubernetes-based infrastructure and DDoS protection.

- Hosted mining and Realtime Hashrate Management via our proprietary Control Hub — powerful for data centers and large operators.

- Full-featured mobile apps (iOS, Android) so you’re always in control wherever you are.

- Dedicated, real human online support—no more ticket queues and uncertainty.

Making Your Choice: Quick Summary Table

| Payout Model | Best For | Main Benefit | Key Limitation |

|---|---|---|---|

| PPS | Hobby miners, fixed-outflow sponsors, risk-averse | Daily earning predictability, simplicity | Misses out on transaction fee upside |

| FPPS | Growth-focused miners, large farms, anyone post-halving | Maximized profit during high-fee/block periods | Slightly more complex calculation, traditionally higher (but not at Headframe) fees |

Bottom Line: Should You Switch to FPPS?

This post-halving, fee-driven BTC ecosystem massively rewards those who optimize every aspect of their operation—including payout models. If you want to ensure you’re not losing out on the biggest new profit driver in mining (transaction fees), FPPS is the way to go. There’s no technical risk, no extra wait, and at Headframe there’s no extra cost—just simple, transparent BTC credits to your wallet each and every day.

Still have questions or want to estimate your possible gains? Our team is always online to help—check out our official Headframe BTC Mining Pool page for full details, calculators, and to start optimizing your mining with confidence.